Freddie MacAUS - LP

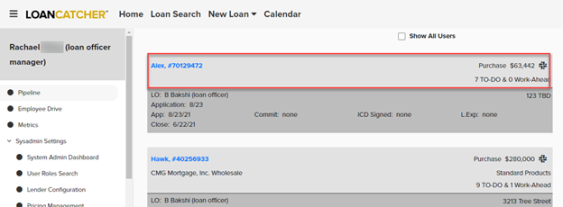

Click anywhere in the light gray header, on the main dashboard, for the desired loan.

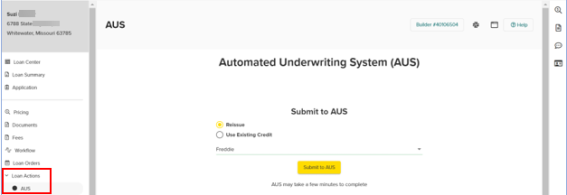

The left navigation column displays loan options, including AUS, which is located under the Loan Actions heading.

Click AUS.

In order to use this feature, a relationship with Freddie Mac must be set up first. Contact Freddie Mac directly to establish such a relationship, if needed.

Not all entities chose to enable AUS findings within LoanCatcher℠. Entities may elect to run AUS at the lender site or directly in the appropriate website.

File(s) should be complete before AUS is completed, including full 1003 (ensure liability mortgages are tagged to payoff/REO), credit pull, pricing and status set to Registration.

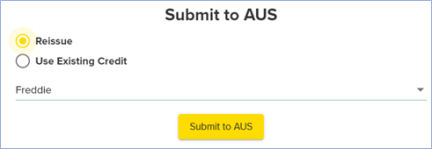

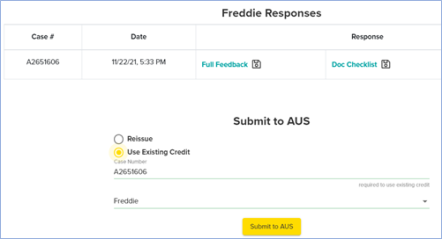

The default selection is Reissue. This runs initial findings using the existing Credit Report pulled through LoanCatcher℠. Select the underwriting system(Freddie).

Click Submit to AUS when ready.

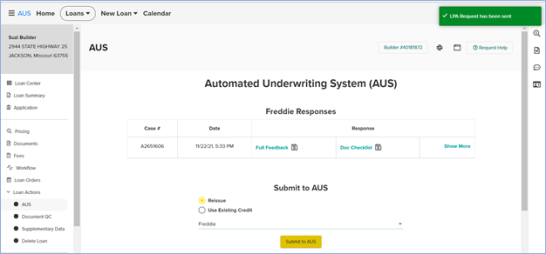

AUS may take a few minutes to complete. A confirmation notices appears when AUS findings are successfully returned. Additionally, the AUS screen now reflects a historical list of Freddie Responses.

The Freddie Responses section includes Case #, Date and Response.

Click Show More on the right side to expand the Response section. Now, the HVE (Home Value Explorer) is accessible.

To review an option, click directly on the title of the desired Response option. Available options include Full Feedback, Doc Checklist and HVE.

Click

![]() to open a pdf version of the document.

to open a pdf version of the document.

Example of Full Feedback:

![]()

Example of Doc Checklist:

![]()

Example of HVE.

![]()

In addition to being available on the AUS screen, all documents associated with the AUS findings automatically appear under the Integration Document section of the Documents page.

![]()

If AUS needs to be rerun after initial findings are received, select Use Existing Credit. This option retains the existing Case # and uses the Credit Report in file for subsequent AUS findings.

Typically Reissue, is selected for the initial AUS findings and Use Existing Credit is selected for subsequent findings.

Standard flow:

Once the file status is set to Registration, follow the lender’s procedures for importing the loan application and AUS findings.

New or Corrected Credit Report

Follow the steps below when an application requires a corrected or new credit report after AUS findings have been retrieved.

-

As appropriate, pull or reissue a new Credit Report into LoanCatcher℠.

-

The next time AUS is completed after a new Credit Report issued, select Reissue. This creates a new LPA Case Number and uses the most recent credit report for findings.

-

All subsequent AUS findings should be retrieved using the Use Existing Credit option.

-

Once the file status is set to Registration, follow the lender’s procedures for importing the loan application and AUS findings.