Manual Pricing

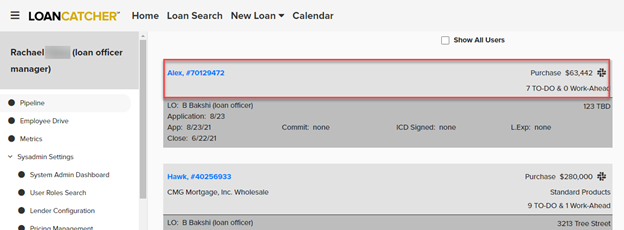

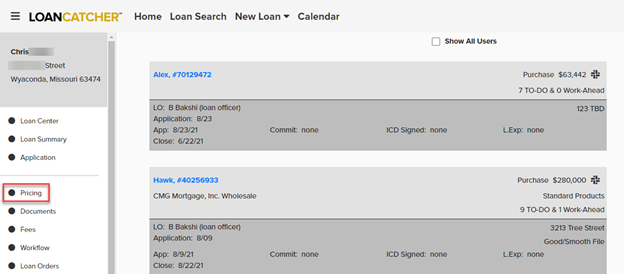

Click anywhere in the light grey header for the desired loan on the main dashboard.

The left navigation column displays loan options, including Pricing. The Pricing option is also available in the left frame while in the loan file.

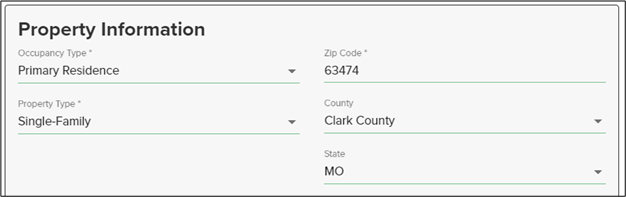

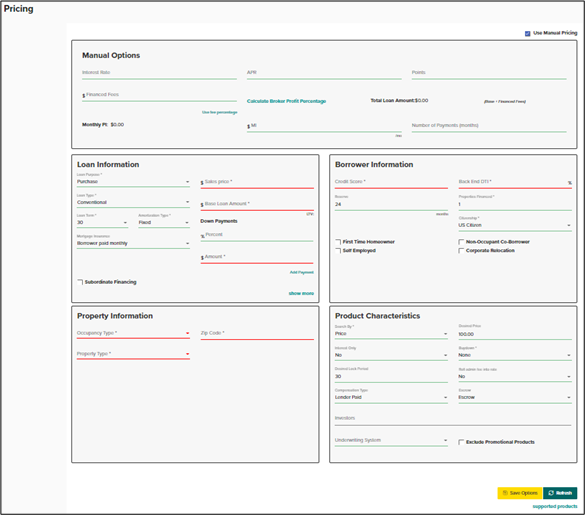

Initially, the Pricing screen has 4 sections: Loan Information, Borrower Information, Property Information and Product Characteristics. These sections include data that carried over from the loan application.

Check the Use Manual Pricing box to begin using manual pricing. This box is automatically checked for clients exclusively using manual pricing.

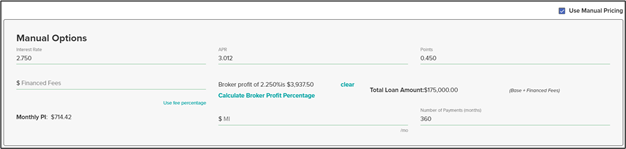

The Manual Options section appears.

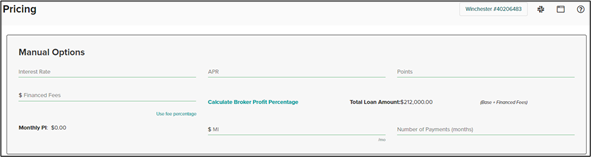

LoanCatcher℠ users that elect to use manual pricing will obtain the necessary pricing details from the lender site and enter the information into the Manual Options section.

Field Descriptions

-

Interest Rate: Obtain this pricing detail from the lender site.

-

APR: Obtain this pricing detail from the lender site.

-

Points: Obtain this pricing detail from the lender site. Information entered here carries over to the Fees page in Origination Section A as Points charge.

-

Financed Fees: As applicable, enter the guarantee/funding fee when using an FHA, USDA or VA product. Obtain this pricing detail from the lender site. See the Financed Fees section below for more details.

-

MI: Mortgage Insurance monthly amount.

-

Number of Payments (months): Number of payments as a monthly amount. For example, enter 360 for a 30 year term.

-

Calculate Broker Profit Percentage: Calculates the broker profit as a percentage. See the Calculate Broker Profilt Percentage section below for more details.

The Manual Options section also contains two non-editable fields - Total Loan Amount and Monthly PI.

The Total Loan Amount automatically calculates based on figures entered for Base Loan Amount and Financed Fees.

Monthly PI automatically calculates the monthly Principal and Interest payment based on amounts entered for Total Loan Amount, Term, and Interest Rate.

Financed Fees

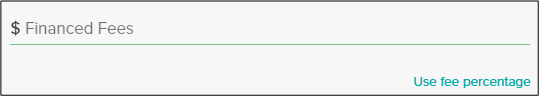

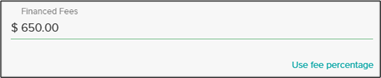

The Financed Fees input defaults as a flat fee entry. As applicable, enter the guarantee/funding fee when using an FHA, USDA or VA product. Obtain this pricing detail from the lender site.

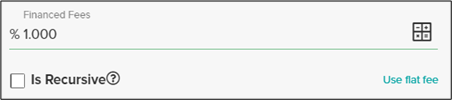

To enter a percentage instead of a flat fee, click Use fee percentage.

Example: Flat Fee entered in Financed Fees section.

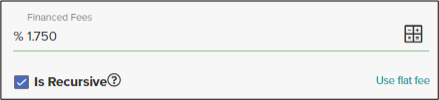

Example: Financed Fees entered as a percentage

When Financed Fees are entered as a percentage, the Is Recursive option is available. Check this box when the fee calculates with a repeating percentage.

Click Use flat fee to revert to the flat fee option.

Calculate Broker Profit Percentage

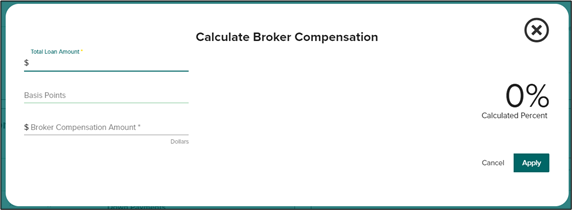

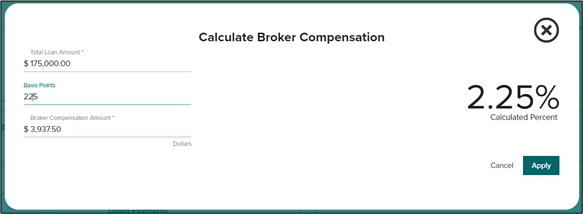

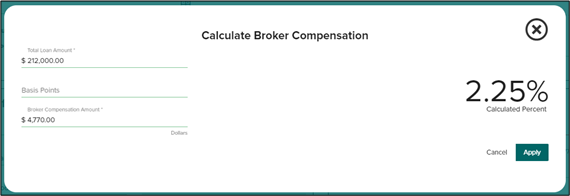

Click Calculate Broker Profit Percentage to open the Calculate Broker Compensation dialog.

Enter the Total Loan Amount.

If appropriate, enter Basis Points.

The Broker Compensation Amount and Calculated Percent are automatically calculated.

If Basis Points are not entered, then enter Broker Compensation Amount.

Result: Calculated Percent is automatically calculated.

Click Apply.

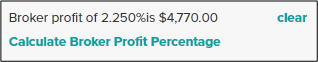

The Calculate Broker Compensation dialog is closed and the Broker profit is displayed directly above the Calculate Broker Profit Percent link.

If needed, click clear to remove the Broker profit calculations.

Save Manual Pricing

Example: A complete Manual Options section.

When the Manual Options section is complete, click Save Options at the bottom of the page.

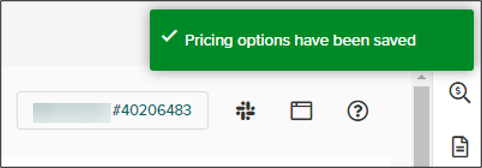

Result: The Saving Pricing Options progress dialog appears.

When the pricing options are saved, a confirmation appears in the right corner.